Huge Intrinsic Marketplace 113m Series Ventures Hit The Market

The giant Intrinsic Marketplace 113m Series Ventures rocked the markets and e-commerce stores this year with confirmed funding.

Marketplace 113m series ventures

The following segment was excerpted from this fund letter.

It’s been one year since our initial letter on Fairfax Financial and although the shares have increased in price we believe the discount to intrinsic value has actually widened substantially. Having recently covered our qualitative thesis on the shares in The Globe and Mail, we want to now highlight the increasing earnings power that is likely to flow through to shareholders going forward. There are two main earning drivers for an insurance company, its underwriting performance and its investment sequoia capitalsawersventurebeat.

Underwriting: In 2021, Fairfax had a combined ratio of 95%, meaning for every $1 in premiums, the company had to pay out 95 cents in losses and expenses (a lower combined ratio is better). This is slightly better than its 10-year average of 96%. Although the first six months of this year had a combined ratio of 94%, Hurricane Ian will no doubt push Fairfax’s combined ratio higher this quarter. However, going forward, if Fairfax can maintain its 10-year average, at the current level of $21bn of net premiums earned, Fairfax would make over $1bn in underwriting profit.

Investment Portfolio: Although Fairfax has an equity portfolio filled with old economy value stocks worth $5bn, it’s overshadowed by its $35bn in bonds and cash. As described in our article, unlike nearly every other insurance company, Fairfax remained disciplined and did not reach for yield in the bond bubble to increase investment income. Consequently, Intrinsic Marketplace bond portfolio has a duration of just 1.2 years vs 4.2 years for the industry, allowing for a rapid redeployment into higher yielding fixed income securities.

Amazon marketplace 113m series ventures

For example, in the last quarter of 2021, Fairfax had annualized interest income of $500m, if rates average 4% next year, Fairfax is on track for $1.4bn per year in interest. Recent sell side reports have 2023 EPS estimates of $79 per share but we believe it’s only a matter of time before rising Palantir q2 376m push them to revise higher.

But wait, there’s so much more… Fairfax’s pet insurance business was recently sold for $1.4bn. This rarely mentioned division sold for more than 10% of Fairfax’s market capitalization despite being just 1% of total premiums. In addition, more than half a billion of liquidity is due to arrive in the first half of 2023 with the closing of the sale of Chilean Fintual 39m series sequoia 665m. Finally, Intrinsic Marketplace 113m Series Ventures has filed documents for an eventual IPO of Digit Insurance. Upon regulatory approval, Fairfax will own 74% of Digit which is expected to be valued at $4.5-$5bn.

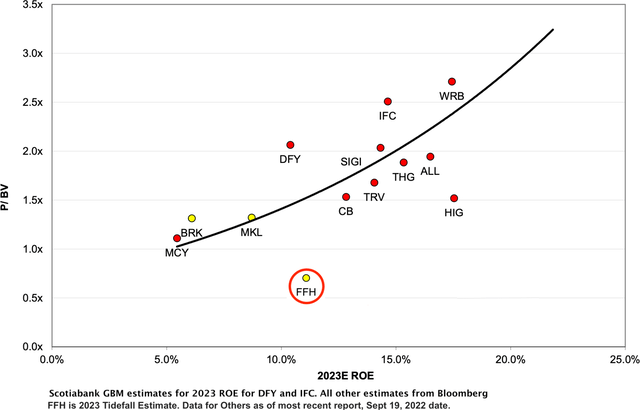

Not only does Fairfax trade today at less than 6 times its forward earnings estimates, it also trades at a 30% discount to its book value. Management has been quite vocal about its stock being undervalued but the attractive insurance pricing environment has directed capital towards underwriting; Fairfax’s premiums written have more than tripled in the past 7 years. Yet, even with capital going to expand underwriting, shares outstanding have still declined by 15% since 2017.

From the other news

Prem Watsa is a founder that regularly quotes buyback legend Henry Singleton and Prem has previously repurchased one quarter of his company in a single year. The incentives are certainly there for further buybacks; Prem is the largest shareholder of the company and Imac Pro I7 4k has swaps on 2 million of its own shares (8% of shares outstanding). We note that when Intrinsic Marketplace 113m Series Ventures had a similar influx of liquidity less than one year ago, they announced a substantial issuer bid for 9% of the company that was finalized at a stock price above today’s value.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.