PrimeARB AI vs 3Commas vs Cryptohopper: Which Arbitrage Bot Wins in 2026?

If you’re tired of the emotional rollercoaster of crypto trading and looking for a way to earn regardless of whether Bitcoin soars or crashes to zero, this article is for you. Today we’ll compare three popular solutions for automated cryptocurrency trading—and explain why one of them is fundamentally different from the rest.

The Problem: Why Most Crypto Traders Lose Money

According to various studies, 70% to 95% of retail crypto traders lose money in the long run. The reasons are banal:

Emotional burnout. You wake up at night to check Bitcoin charts. Every red day is stress, every 5% swing triggers panic or greed.

Market direction dependency. Bought at the top? Wait years to break even. Panic sold? Missed the rally. The classic “buy high, sell low” trap.

Technical errors. Manual trading across multiple exchanges means registering on 5-10 platforms, managing dozens of API keys, constantly monitoring balances and transferring funds.

Competition with professionals. You’re trading against algorithmic funds with microsecond latency, teams of mathematicians, and hundreds of millions in capital.

Traditional trading bots like 3Commas and Cryptohopper try to solve the automation problem, but they have a fundamental weakness: they still depend on market direction. Their DCA (Dollar Cost Averaging), Grid Trading, or trend-following strategies only work when the market moves in the right direction. If Bitcoin drops 50%, your DCA bot will buy all the way down, holding drawdowns for months.

What is Futures Arbitrage: An Educational Primer

Before comparing platforms, it’s important to understand the basic concept that makes one of them fundamentally different.

Arbitrage is Not Trading

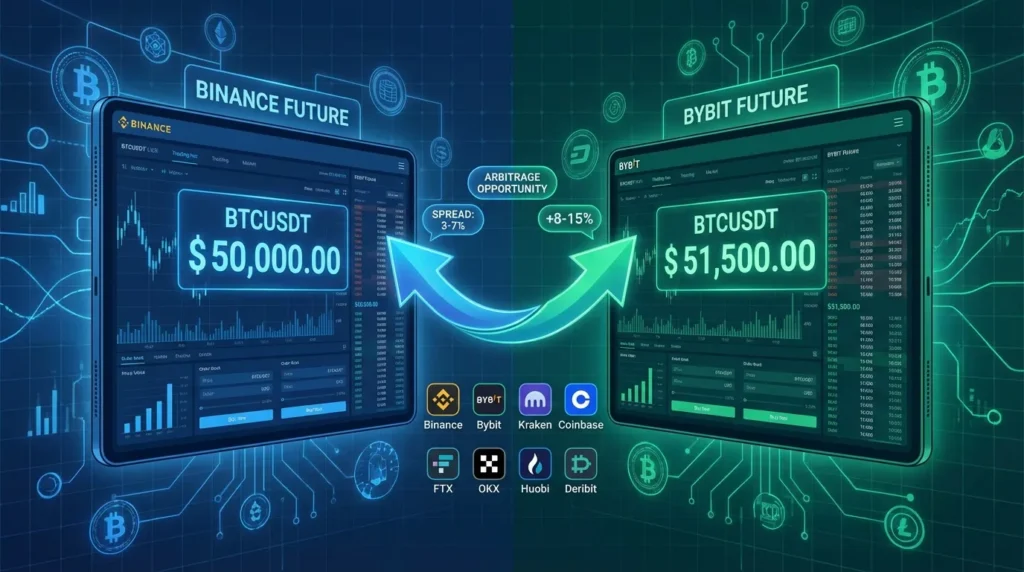

Imagine: Bitcoin costs $85,000 on Binance and $87,550 on Bybit. The difference is 3% or $2,550. What does an arbitrageur do?

- Opens a long (buy) on Binance at $85,000

- Simultaneously opens a short (sell) on Bybit at $87,550

- Waits for price convergence—usually happens within hours or days

- Closes both positions when prices equalize to, say, $86,275

Result:

- On Binance: bought at $85,000, sold at $86,275 → profit +$1,275

- On Bybit: sold at $87,550, bought at $86,275 → profit +$1,275

- Total profit: $2,550 minus fees (~$20) = ~$2,530 net

Key Difference from Speculation

You absolutely don’t care where Bitcoin’s price goes. If BTC rises to $90,000:

- Your Binance long earns money

- Your Bybit short loses the same amount

- But the spread between exchanges still closes, and you collect that difference

If BTC falls to $80,000:

- Your long loses

- Your short earns

- Spread closes again, profit in pocket

This is called a market-neutral strategy—the Holy Grail of professional hedge funds.

Why Do These Spreads Occur?

The cryptocurrency market is fragmented. There are over 600 exchanges, each with its own liquidity, price update speed, and user base. When panic starts in Asia and Chinese traders massively dump positions on OKX, the price there drops faster than on European Binance. A temporary window opens—a 3-7% spread that professional arbitrageurs instantly exploit.

These inefficiencies are constant. As long as the market is decentralized and volatile, they’ll appear again and again. Arbitrage funds target 30-60% annual returns on precisely this strategy.

Platform Comparison: PrimeARB AI vs 3Commas vs Cryptohopper

Now that we understand the difference between speculative trading and arbitrage, let’s compare the tools.

3Commas: DCA Strategy Master

What it is: Popular platform for trading automation focused on DCA bots and social signal copying.

Main strategies:

- DCA (Dollar Cost Averaging): Bot buys assets when price drops, averaging position

- Grid Trading: Places a grid of buy/sell orders in a specific range

- Signal copying: Replicates trades of successful traders

Exchange support: Binance, Bybit, OKX, KuCoin, Coinbase, and 15+ others

Cost: From $22/month (basic plan) to $99/month (Pro)

Critical weakness:

All 3Commas strategies are directional bets. If you launched a DCA bot to buy Ethereum on dips, and ETH continues crashing from $3,000 to $1,500, the bot will buy all the way down. Your deposit will be “frozen” in losing positions for months. Yes, when the market reverses, you’ll recover losses and even profit. But this is classic speculation with additional risk: your capital is tied up for an indefinite period.

Best for: Traders who believe in long-term growth of specific coins and want to automate averaging strategies.

Cryptohopper: Trading Strategy Constructor

What it is: Cloud platform with visual strategy editor and marketplace for ready-made solutions.

Main features:

- Strategy Designer: Creating custom trading algorithms without coding

- Trailing Stop Loss: Automatic profit-taking

- Arbitrage and Market Making: Yes, Cryptohopper claims arbitrage, but it’s cross-exchange spot arbitrage, fundamentally different from futures arbitrage

Exchange support: 16+ exchanges including Binance, Kraken, Bitfinex

Cost: From $19/month (Pioneer) to $99/month (Hero)

Why their “arbitrage” isn’t the same:

Cryptohopper offers classic cross-exchange arbitrage: buy Bitcoin on Binance for $85,000, transfer to Bybit, sell for $87,550. Problem: transfer takes 10-30 minutes, by which time the spread has already closed. Plus withdrawal fees (up to $50 for BTC) eat the profit. This strategy worked in 2017 when spreads reached 15-20%. In 2026, it’s dead.

Best for: Experienced traders who want to test complex strategies and are willing to pay for access to other users’ signals.

PrimeARB AI: Next-Generation Futures Arbitrage

What it is: Specialized system for futures arbitrage with complete infrastructure automation.

Key differences:

1. Market Neutrality

Unlike 3Commas and Cryptohopper, PrimeARB AI doesn’t bet on market direction. The system simultaneously opens opposite positions (long and short) on different exchanges, earning on spread convergence. Market drops 30%? Your portfolio stays positive. Grows 50%? Profit still flows.

2. Automatic Sub-Account Creation on Exchanges

This is a revolutionary feature. Traditionally, for arbitrage you need to:

- Register yourself on 8 exchanges

- Pass KYC on each (upload passport, selfie, wait for verification)

- Create and configure API keys with correct restrictions

- Manually distribute capital between exchanges

PrimeARB AI does all this automatically. You deposit into a unified system interface, and it:

- Creates sub-accounts on partner exchanges (Binance, Bybit, MEXC, Gate.io, Bitget, BingX, OKX, WEEX)—these sub-accounts are registered under your name

- Automatically distributes capital optimally

- Configures internal APIs for high-speed trading

You manage everything through one dashboard. No dozens of browser tabs.

3. Statistics and Positive Expected Value

According to PrimeARB AI data, 93% of trades close with positive results. This is possible thanks to strict signal selection: the system enters arbitrage only at spreads of 3% and higher, sufficient to cover fees (typically 0.20% for opening+closing two positions) and generate profit.

Real example from statistics:

ZEC/USDT pair on Bybit and Bitget exchanges showed a 7% spread. The system opened a long on Bybit and short on Bitget. After several days, prices converged:

- Bybit (long): +$210

- Bitget (short): -$57

- Net profit: $153

4. Execution Speed

Arbitrage windows live for seconds or minutes. PrimeARB AI uses high-speed dedicated servers with minimal ping to exchanges (latency <100 milliseconds). When the screener detects a spread, orders are placed simultaneously on two exchanges in fractions of a second. Manual trading or slow bots will have already missed the opportunity.

5. Security and Control

- Funds remain on exchanges, PrimeARB AI doesn’t store client cryptocurrency

- API keys created without withdrawal rights—system can only trade and read balances

- KYC verification is mandatory for compliance with international AML requirements

- Stop-losses set at exchange level—even if internet disconnects, protection remains active

Comparison Table

|

Parameter |

PrimeARB AI |

3Commas |

Cryptohopper |

|

Strategy Type |

Futures arbitrage (market-neutral) |

DCA, Grid, signals (directional) |

Multiple strategies (directional) |

|

Market Direction Dependency |

❌ No |

✅ Yes |

✅ Yes |

|

Auto Sub-Account Creation |

✅ Yes (8 exchanges) |

❌ No |

❌ No |

|

Unified Deposit |

✅ Yes |

❌ Manual distribution needed |

❌ Manual distribution needed |

|

Realistic Returns |

8-15% monthly (balanced mode) |

Market-dependent, can be negative |

Market-dependent |

|

Successful Trade Rate |

93% |

Not disclosed |

Not disclosed |

|

Minimum Capital |

$3,000-5,000 recommended |

From $500 |

From $500 |

|

Cost |

[check with company]

$22-99/month

$19-99/month

Setup Complexity

Low (automated)

Medium

High (strategy understanding needed)

Target Audience

Investors seeking stability

Active optimistic traders

Experienced algo traders

Realistic Returns: No Rose-Colored Glasses

Let’s be honest. PrimeARB AI isn’t “10% daily” or “guaranteed million per year.” It’s a systematic tool with clear mathematics.

Three Operating Modes:

Conservative (30-50% of deposit working):

System uses smaller capital portion, focusing only on large spreads (4%+). Expected return: 3-8% monthly. Suitable for those who want to minimize risk and volatility.

Balanced (60-70% of deposit working):

Optimal mode for most users. System enters trades at 3%+ spreads, balancing frequency and profit size. Expected return: 8-15% monthly.

Aggressive (80-90% of deposit working):

Maximum capital utilization, entering even small spreads (from 2.5%). Higher trade frequency but also higher drawdown risk. Expected return: 15-25% monthly.

Annual Perspective with Compounding:

Starting with $10,000 in balanced mode (10% monthly) with profit reinvestment:

- After 12 months: $31,384 (214% growth)

- Conservative (5% monthly): $17,958 (80% growth)

This significantly exceeds traditional investments in bonds (3-5% annually) or dividend stocks (7-10% annually), but requires understanding of risks.

Addressing Common Objections

“This sounds like quick money, probably a scam”

Understandable skepticism. But futures arbitrage isn’t a new scheme—it’s a proven strategy. Professional arbitrage funds (e.g., Alameda Research pre-collapse, Jump Trading, Wintermute) earned precisely this way. The difference is they had hundreds of millions of dollars and teams of developers. PrimeARB AI makes this strategy accessible to retail investors.

Key difference from scams: Your funds remain on your exchange accounts. The system doesn’t collect money into a “common pool,” doesn’t promise to “attract new participants.” You can withdraw capital from exchanges anytime.

“What if internet disconnects during a trade?”

Stop-losses are set at exchange level, not in PrimeARB AI interface. This means even if the company’s servers are unavailable or your internet drops, protection from catastrophic losses remains active. The exchange automatically closes positions when reaching a certain loss level (typically -2% from spread).

Additionally: PrimeARB AI’s high-speed servers have backup communication and power channels.

“How much capital is needed?”

Technical minimum: $500-1000—system will work, but trading pair selection is limited, diversification minimal.

Recommended start: $3,000-5,000—optimal balance between risk and return. System can hold 2-3 open positions simultaneously, diversifying across different assets.

Comfortable level: $10,000+—full diversification, maximum algorithm efficiency.

Why not less? Exchange fees are fixed. If you trade with $100, 0.20% fee ($0.20) seems insignificant. But with a 3% spread ($3), your real profit is only $2.80. With $5,000 capital, the same trade brings $140 net profit.

“Is this safe? How can I be sure?”

Multi-layered security:

- KYC verification: Yes, it’s inconvenient. But it’s a guarantee that the company operates legally and complies with international AML requirements.

- API without withdrawal rights: Even if someone gains access to your PrimeARB AI account (unlikely with 2FA), they cannot withdraw your cryptocurrencies from exchanges.

- Funds on exchanges, not with company: Unlike custodial services (where company holds your money), here your capital is always on your exchange account. PrimeARB AI cannot “run away with the money.”

- Transparent statistics: System provides detailed reports for each trade—you see when position was opened, at what price, fees, result.

Verdict: Who Wins in 2026?

3Commas and Cryptohopper are excellent tools for active traders who believe in specific coins and want to automate averaging or grid trading strategies. If you think Ethereum will be worth $5,000 in six months and are ready to wait, averaging purchases, these platforms are for you.

PrimeARB AI is a solution for investors who want to earn regardless of market direction. You’re not betting on Bitcoin rising or falling. You’re exploiting structural market inefficiency—price differences between exchanges. This is closer to professional hedge funds than speculative trading.

Choose PrimeARB AI if:

- ✅ You value return stability over lucky altcoin bets

- ✅ You want to sleep peacefully without checking charts every hour

- ✅ You don’t want to register on 8 exchanges yourself and configure APIs

- ✅ You value mathematically sound strategies with positive expectation

- ✅ You have capital from $3,000 and investment horizon of 6-12+ months

Stay with 3Commas/Cryptohopper if:

- You’re an active trader who enjoys analyzing markets and picking coins

- You believe in long-term growth of specific cryptocurrencies and ready to weather drawdowns

- You need configuration flexibility and access to multiple strategies

- You want to experiment with different approaches for a fixed monthly fee

First Steps with PrimeARB AI

If the idea of market-neutral earnings interests you, here’s a clear action plan:

Step 1: Registration and Verification (3-5 minutes + 1-2 days for review)

Go to official PrimeARB AI website, register with real email, upload passport for KYC. Wait for confirmation.

Step 2: Deposit (5-30 minutes)

Transfer capital (recommended start with $3,000-5,000) in USDT or other stablecoin. System automatically creates sub-accounts on exchanges and distributes funds.

Step 3: Choose Operating Mode

For first time, conservative or balanced mode is recommended. Save aggressive for later when you see how the system works.

Step 4: Launch and Monitor

Activate algorithm. First trade usually appears within 24-48 hours. In dashboard you’ll see:

- Current open positions

- History of closed trades with profit/loss

- Overall return statistics

Step 5: Reinvest or Withdraw

Decide whether to reinvest profit (for compound interest effect) or withdraw periodically. Many start with reinvesting first 3-6 months, then withdraw part of profits.

From Speculation to Systematic Income

2026 is when the cryptocurrency market matures. Speculative “buy and wait for moon” strategies give way to professional, quantitative approaches. Futures arbitrage isn’t a magic “become millionaire in a month” button. It’s an engineering approach to investing, where profit comes not from luck but from exploiting structural market features.

PrimeARB AI removes the main barriers to entry in this strategy: need for technical knowledge, manual work with multiple exchanges, high infrastructure costs. You get a tool that was previously only available to hedge funds with hundreds of millions in capital.

Yes, it requires capital (from $3,000), patience (returns measured in monthly percentages, not daily), and understanding that even with positive expected value, losing trades occur. But if you’re tired of emotional rollercoaster trading and want a system that works regardless of whether the market rises or falls, this is your option.

The next step is yours. Register, pass verification, start with conservative mode. Give the system 2-3 months to evaluate it in action. And perhaps you’ll finally stop being hostage to crypto volatility—and start earning from it.

Disclaimer: Cryptocurrency trading involves risks. Arbitrage reduces market risk but doesn’t eliminate it completely. Drawdowns, technical failures, liquidity changes are possible. Invest only funds whose loss you can afford. This material is not financial advice—it’s educational content for making informed decisions.