What is the easiest mortgage to get with bad credit?

You know how a single missed payment can follow you around for years, even when your finances are stable again. That’s the frustration behind most searches for bad credit mortgages, you are trying to work out what you can realistically get approved for, and what it will cost.

In the UK, there isn’t one magic lender or one “easy” product. The easiest route is the one that matches your credit record, deposit, and affordability on the day you apply.

This guide pulls it into a practical plan: what lenders mean by bad credit, the main types of bad credit mortgages available in the UK, and the specific steps that improve approval odds.

Key Takeaways

- Bad credit usually means recent missed payments, defaults, CCJs, or insolvency markers. A CCJ can affect access to lending for up to six years, even if you later settle it (as explained by Experian).

- Deposit size changes your lender pool fast. With adverse credit, many lenders expect a bigger deposit (often 15% to 25%+), while mainstream low-deposit deals tend to be stricter on credit history.

- The UK Mortgage Guarantee Scheme (from July 2025) supports 91% to 95% loan-to-value repayment mortgages for eligible buyers, but it is not for buy to let mortgages and it excludes many forms of “credit-impaired” applicants (per the scheme rules published by HM Treasury).

- Near-prime mortgages sit between prime mortgages and sub-prime mortgages. For example, Atom Bank’s Near Prime criteria lists limits such as up to 4 CCJs in total (none in the last 12 months) and £1,000 combined unsatisfied CCJ value per applicant, with separate rules for defaults (as of its published criteria updated in late 2025).

- The fastest wins are usually: fix credit report errors, stabilise your bank statements, reduce unsecured debts, and use a mortgage broker who regularly places adverse cases, such as Revolution Finance Brokers.

What counts as bad credit?

“Bad credit” is not a single score. It’s a pattern in your credit record that suggests higher risk to a lender.

In practice, lenders look for the events behind your credit scores, not just the number itself: missed payments, defaults, arrears, CCJs, debt management plans, IVAs, and bankruptcy, plus how recently any of those happened.

- Recent missed payments on credit cards, loans, mobile contracts, or utilities.

- Defaults and arrangements to pay, especially in the last 12 to 24 months.

- County Court Judgments (CCJs), whether satisfied or unsatisfied.

- Insolvency events (IVA, bankruptcy, protected trust deed) and when they were discharged.

- Lots of applications in a short period, which can look like financial pressure.

A low score can raise costs and reduce choices, but the “why” behind the score is what decides which lenders will lend.

A key point many people miss is timing. Experian explains that a CCJ can remain on your credit file for up to six years, and paying it does not automatically remove it, unless it is paid within one month or set aside by the court.

Less-than-perfect credit often follows a life event, such as illness or redundancy, after a period of good credit. That context matters, but you still need to show the underwriter that things have stabilised through steady repayments, manageable debts, and clean recent conduct.

Types of bad credit mortgages available in the UK

In the UK market, “bad credit mortgages” usually means specialist residential lending from lenders who accept more adverse credit than high-street criteria, plus a few alternative routes that can reduce the deposit hurdle or improve affordability.

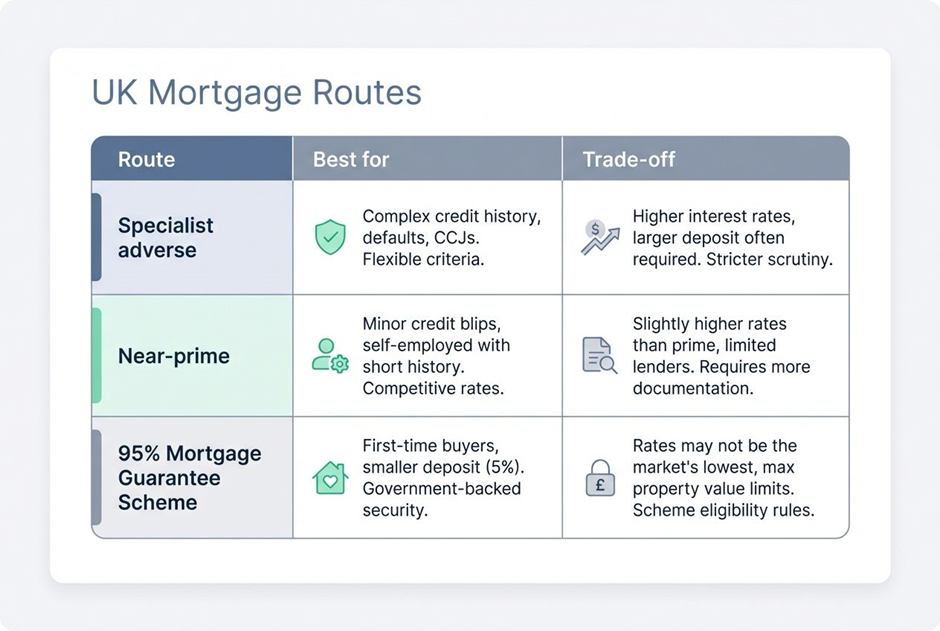

| Route | Best for | Typical trade-off |

| Specialist adverse / sub-prime mortgages | Recent blips, older defaults, CCJs, non-standard income | Higher interest rates and fees, tighter underwriting |

| Near-prime mortgages | Smaller adverse history, improving credit profile | Rates above prime, strict limits on recent adverse |

| 95% mortgages via the Mortgage Guarantee Scheme (where eligible) | Small deposit buyers who are not credit-impaired under the scheme rules | High LTV pricing, repayment-only, owner-occupier focus |

| Rent-track / no-deposit products (limited cases) | Strong rent payment history but little savings | Strict eligibility, affordability still has to work |

| Shared Ownership or Right to Buy (where eligible) | Reducing the amount you need to borrow | Extra rules, leases, fees, and restrictions |

If you are thinking about buy to let mortgages, set expectations early. Buy-to-let lenders often ask for larger deposits, with 25% being a common minimum and 20% to 40% being a typical range (as summarised by Revolution Finance Brokers guide to buy-to-let deposits).

Your home may be repossessed if you do not keep up repayments on your mortgage.

What are specialist adverse credit mortgages?

Specialist adverse credit mortgages (often labelled sub-prime mortgages in older guides) are built for borrowers who fail standard credit scoring at high-street banks.

The “easiest” version is the one that fits your case. In my experience, specialist lenders care most about: how recent the adverse items are, whether they are satisfied, and whether your recent bank statements show stable spending and clean repayments.

- CCJs and defaults are assessed by age and value. Some lenders publish tiered criteria that become more flexible the older the adverse is.

- Affordability still drives the offer. Underwriting focuses on income, committed outgoings, and realistic living costs, not just the credit file.

- Documentation matters more. You will usually need clear evidence of income and your deposit source, plus an explanation of past issues.

As one example of how criteria can be tiered, Kensington Mortgages publishes residential credit ranges where stricter tiers cap recent CCJs and defaults, while more flexible tiers consider older adverse with fewer limits. This is why a broker who places adverse cases daily can save you months of trial-and-error.

Can you use a family-assisted or guarantor-style mortgage?

Family support can be a genuine shortcut, not because it “fixes” bad credit, but because it can strengthen the application in two ways: deposit and affordability.

- Family savings as security: Lloyds Bank’s Lend a Hand mortgage uses a family member’s savings equal to 10% of the purchase price as security, held for 3 years, which can help you buy with a small or no deposit.

- Joint borrower, sole proprietor (JBSP): a family member joins the mortgage for affordability, but you remain the legal owner. This can work well if your income is the constraint, but it increases responsibility for the supporting borrower.

- Gifted deposits: many lenders accept gifts, but they must usually be non-repayable and evidenced properly.

If your credit history includes recent arrears, this route can still be difficult, because the lender may treat the risk as unchanged even with family support. A mortgage broker can help you avoid products that look promising but fail at underwriting.

How can Shared Ownership or Right to Buy help?

If the main obstacle is deposit size and the amount you need to borrow, government-backed routes can reduce the mortgage requirement, which can make affordability and acceptance easier.

Shared Ownership lets you buy a share of a home and pay rent on the rest. UK government guidance on Shared Ownership under the Affordable Homes Programme notes that the minimum initial share can be as low as 10%, and some models allow buying extra shares in small steps.

Right to Buy can reduce the price through a discount if you are eligible. Government guidance updated after late 2024 shows cash discount caps that vary by region, with maximums in England typically between £16,000 and £38,000, and different rules apply across the UK nations.

- Shared Ownership can suit you if you can afford the monthly costs but need a smaller mortgage.

- Right to Buy can suit you if you are eligible and your discount reduces your loan-to-value enough to open more lender options.

- Both routes have extra legal steps, fees, and eligibility rules, so treat them as a separate planning track, not a last-minute add-on.

What are near prime mortgages?

Near prime mortgages sit between prime mortgages and specialist adverse deals. They can be a good fit when you have a small number of issues on your credit file, but you can show clean, stable conduct now.

Near prime is also where you start to see a clear “step change” in pricing once your adverse falls outside the lender’s look-back window and you can move closer to a prime mortgage at remortgage time.

| Credit item | Example of published near-prime limits | How you use this |

| CCJs | Atom Bank lists: 0 in the last 12 months, maximum 4 in total, with combined unsatisfied CCJs capped at £1,000 per applicant (no cap if satisfied) | If you have an unsatisfied CCJ, settling it can widen options even before it drops off your file |

| Defaults | Atom Bank lists: 0 in the last 12 months, up to 4 in 13 to 24 months, unlimited over 24 months, with combined unsatisfied defaults capped at £2,500 per applicant (no cap if satisfied) | Getting defaults marked satisfied can matter as much as waiting for time to pass |

On pricing, Atom Bank’s published Near Prime representative example includes a 2-year fixed at 85% LTV at 5.54% with an APRC of 6.9% (its product pages state rates are subject to change, and its rate table was last shown as updated in late 2025).

How does your credit score affect mortgage eligibility?

Your credit score is a quick signal, but lenders make a mortgage decision using your full credit report, your bank statements, and the affordability model.

Credit scores also differ by agency. Revolution Finance Brokers highlighted that UK credit reference agencies use different ranges, and it also noted Experian’s scoring has been transitioning to a new top score of 1,250, with customers moved over by the end of 2025.

- Credit history: missed payments, defaults, CCJs, and insolvency, with extra weight on anything recent.

- Affordability: income, committed spending, and realistic living costs, plus the impact of future rate rises.

- Loan to value (LTV): higher LTV often means higher interest rates and fewer options, especially with adverse credit.

- Application footprint: too many hard searches in a short window can make the risk model twitchy.

It’s also worth knowing that lenders are required to consider future rate rises in their affordability process. The Financial Conduct Authority has explained that firms have flexibility in how they apply the mortgage stress test, but they still need to take account of likely future increases when assessing affordability.

How can you improve your chances of mortgage approval?

You improve approval odds by making your application easier to underwrite. That means a clear deposit source, stable bank statements, lower unsecured commitments, and a credit file that matches the lender’s policy.

Start by running your numbers through a mortgage calculator, then speak to mortgage brokers or mortgage advisors who can match you to criteria-led lenders, instead of guessing.

Why save for a larger deposit?

A bigger deposit reduces loan to value, which usually improves interest rate options and reduces the lender’s risk if you have a messy credit record.

If you are dealing with adverse credit, think in bands, because lender criteria and pricing often shift at common LTV points.

- 95% LTV: possible for some buyers, but often strict on recent credit issues and may require stronger affordability.

- 90% LTV: typically opens up more lender choice, including some near-prime ranges.

- 85% LTV and below: often where pricing and acceptance improve meaningfully for adverse cases.

A guarantor or family support approach can sometimes replace part of the deposit problem, but it does not remove the need for clean, consistent repayments and affordability.

How can reducing existing debts help?

Cutting existing debts reduces your monthly outgoings and can improve affordability calculations immediately, even before your credit score has time to react.

- Bring down credit card utilisation before application, especially if you are close to limits.

- Prioritise expensive unsecured borrowing first, because high monthly payments hit affordability harder than balance size.

- Stop new borrowing in the run-up to a mortgage, so your bank statements show stability.

- Avoid missed payments at all costs, because new arrears can reset the clock for many adverse lenders.

How do you check and correct credit report errors?

Check your credit report early, not the week you want to apply. It gives you time to fix errors and to show a run of stable behaviour.

Also make sure you are registered on the electoral roll at your current address, and keep your name and address format consistent across bills and accounts.

- Check all three credit reference agencies. UK lenders do not all use the same data source, so review Experian, Equifax and TransUnion, not just one.

- Highlight factual errors first. Look for wrong addresses, duplicate accounts, incorrect balances, or accounts shown as open when they are closed.

- Dispute with the organisation that supplied the data. The lender or provider usually has to correct the record at source, then the agency updates your file.

- Use the formal correction route. Equifax’s published “rights” information explains it must reply in writing within 28 days when you ask for an entry to be corrected or removed.

- Add a short Notice of Correction if needed. If the data is technically correct but misleading, Equifax also explains you can add a note of up to 200 words to give context (for example, redundancy with dates and recovery steps).

- Escalate complaints properly. If a lender refuses to fix an error, complain to the firm first. If you are still stuck, the Financial Ombudsman Service can review complaints about lenders, mortgage advisers and brokers.

Conclusion

There is no single easiest mortgage for people with bad credit. The easiest option is the one that matches your credit history, deposit, and affordability today.

Start with your credit report and a mortgage calculator, then build a plan around deposit, debts, and recent repayment conduct. If you want the quickest route through specialist criteria, speak to a mortgage broker who places bad credit mortgages regularly, and get a clear shortlist before you apply.

FAQs

1. What is the easiest mortgage to get with bad credit?

A mortgage from a specialist lender, or a loan backed by a guarantor, is often the easiest route. Many think no lender will help, that is not true.

2. Can I get a mortgage with a low credit score?

Yes, lenders may accept poor credit if you have a bigger deposit or use a mortgage broker to find specialist options.

3. Are interest rates higher for bad credit mortgages?

Usually, yes, interest rates are higher because lenders see more risk. Shop around and use a broker to compare offers.

4. What steps should I take to improve my chances?

Check your credit report and correct errors. Save for a larger deposit, pay down debts, and consider a guarantor or joint applicant, then speak to a mortgage broker who knows specialist lenders.